1. I've got a job that pays S$2,000 a month (pathetic as a local uni grad, I know).

Updates Since October 2008

Posted by Mister Qian | 2:25 AM | Assets, Income, Investments | 1 comments »Grey Times Ahead - Hopes to Get A Pot of Gold Plunge In Tandem with the Stock Market

Posted by Mister Qian | 8:24 PM | Market Talk | 0 comments » photo by saibotregeel

photo by saibotregeel

Markets these few days have been quite turbulent, it's really scary. The Asian markets rallied today due to the coordinated interest rate cuts by central banks. I guess this may be the last few 'breathers' for the markets before the we head for the plunge. The Market Oracle gives a good review of what has happened in the past week.

Frankly, I don't think it is going to end soon, regardless of all the coordinated efforts that the governments are doing. Warren Buffett and Li Kah Shing who made respective buys into Goldman, GE and Bank of East Asia, have all seen their investments turn red.

News have reported that the hedge funds are pulling out their cash from the market because they forsee that their clients are gonna ask for withdrawals by the end of this year. Aside from the tight credit in the money market, this is another key factor as to why there is a huge sell-out lately.

I believe more bad news are waiting to hit. It seems thatt everyone is waiting for the last min before they announces how much bad debts they have. Yesterday, FerroChina (listed on SGX) have officially announced that they are going to default on a few hundred millions worth of debt. Counterparties are gonna be hit, and I think Ferrochina is only the first to come clean.

Today, ST reports the further plunging of various stock indexes. Even the insurers are not spared. Yamato Life Insurance and New City Residence Investment Corp reportedly when bankrupt.

Not an exciting time for a fresh graduate with little cash. No opportunity to earn the obsence large salaries my seniors were getting and no money to pick up bargain blue chips in the coming months of the depressing stock exchange.

Tough years ahead man. Good luck everyone!

How Much Money Do You Give To You Mom and Dad?

Posted by Mister Qian | 9:16 AM | Family | 0 comments »September was the first official month I started contributing to the family expenses. It's a modest $100 which I hope to grow that amount in time. Gave it out of the meagre tuition fees I make. It was a relatively comfortable amount, given that I was to receive Growth Dividend from the government.

Mom refuses to take the money and insisted I gave to Dad if I wanted to. Afterall, my tuition loans are yet to be paid.

"Better use what you have to pay back the bank," she said

I obliged. Dad received the money with a simple thanks. $100 is very little. But it could have gotten me some clothes or shoes. It was a symbolic moment, quite unlike a normal gift - it's the begining of financial responsibility. That moment, I had mixed feelings - it was a moment of joy found in giving, a revelation of the sacrifices Mom and Dad made over the last 23 years putting me through life and school and the reality of shouldering a financial responsiblity.

It was not a pleasant feeling of being able to give such a small amount. But I believe it is a good start. Honoring our parents is so important - what other better ways than to provide for them financially?

My siblings give a total of $1000 a month to my parents.Eldest sibling is married. Second sibling stays at home.I just graduated with a meagre $2,000 salary.In my shoes, how much will you give?

Photo source: zulkamal , Flickr.com

As it turned out, I did not become the personal banker I wanted to. It was a good thing, given the trying time now for the banks - especially those doing consumer services.

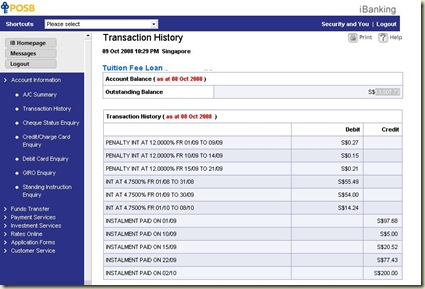

Did a part time course after my University education which cost me SGD1,500. Didn't managed my finances well enough - the interest for my education loan kicked in. As of today, my net worth is an impressive $-12,797. September was a bad month. Every dollar into my account was deducted by the ever-efficient POSB (see above picture). I was left with $1 (the minimum to keep the account open) most of that month. Made a silent vow (again) never to let that happen. Who would thought a romantic $200 date would cause me to be so broke?!

Late September:

Found myself a job. Currently on the second week of it. Spent little on food because the boss brought me around most of the lunches meeting clients, suppliers and service providers.

Spent $15 on blank cds and $9.90 for a cable organizer. Minimum spending on other things.

Recession is kicking in. It's good to be prudent with spending. I am determined to pay off the debt within a year -or less.

Received this email on my inbox today:

Hi XXXX,

Thank you for taking time off to come to our

office for the discussion.

We have carefully considered your

application but regret to inform you that your application has been unsuccessful

as the other candidates have a closer fit to our requirements. Should

there be other suitable opportunities, we will be contacting you.

We appreciate your interest in our Bank and wish you all the best

for the future.

Best Regards,

XXXXX

Human Resources

XXX Bank

It's a little disheartening. Afterall, most of my friends have secured a job before graduation. With only a month left before the end of exams, I need a sign that I can actually get started on getting financially freed.

Why Poverty Could Be Your Greatest Gift Towards Financial Success

Posted by Mister Qian | 5:39 AM | Debt, Economic Outpatient Care | 0 comments » I received a letter from the Office of Finance for my tuition fees for my final semester in college last Friday. This term's bill: S$657.95 (including a $10 late fine).

I received a letter from the Office of Finance for my tuition fees for my final semester in college last Friday. This term's bill: S$657.95 (including a $10 late fine).Welcome to Mister Qian!

My name is Mister Qian and I am an anonymous 20 something year old recent graduate from a Singapore University and an aspiring Private Banker in one of the largest local financial insitutions. This online journal chronicles my journey to financial independence. I write about how much money I make, what I spend it on, how much I save, how I budget, my financial goals and ambitions, my thoughts on class and what it means to be rich or poor and anything else that relates to money.

My short term financial goals are as follows:

If you take any of my advice, do so at your own risk. Always consult your personal financial advisor before acting on the tips here. If you have advice to share, please do, and many thanks!

Disclosure:

10% of all ad revenues from this site go towards charity and the rest goes to paying off my school loans.